You are all familiar with the survey tools, but you are unable to explain in detail why they are essential, what they are used for, how to implement them, etc.

In this article, we will answer all possible and unimaginable questions to save you time!

Let’s start with the basics:

What are Survey tools?

Survey tools allow you to get into the inner workings of your business, whether it’s to better understand your customers, your employees or your employees’ employees.

Surveys are part of the “customer journey” process that many companies experience. These surveys are a set of questions that allow you to get feedback from your respondents in order to improve.

But we can ask a question…

Why are Survey tools so important?

They work as a key component to understanding the needs of the ‘user’ in order for operational teams to excel in the work they do. It’s important to note that they are only the first part of the feedback process – the second part is the data analysis and interpretation.

To further understand why surveys are important, let’s look at the implementation and best practices of survey tools.

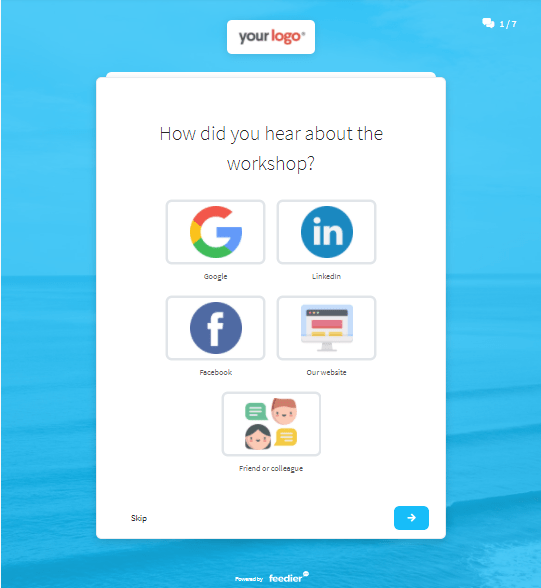

Create Gamified Surveys

Gamification is the process of adding video game elements to another domain of activity as a way to encourage people to engage with your product or service.

Choose a platform that has interactive and engaging surveys, using a combination of aesthetically pleasing forms and clear and targeted questions will help you get better response rates and will encourage your participants to fill out a future survey.

The opposite of play is not work, but depression

Janaki Kumar

Defining your audience

You first have to start defining the end goal of your campaign. Few examples could be:

- I want to validate my new features from a segment of active users

- I want to find out what my new employees think about the onboarding process.

- I’m interested to understand what my client’s think about the service they recently received.

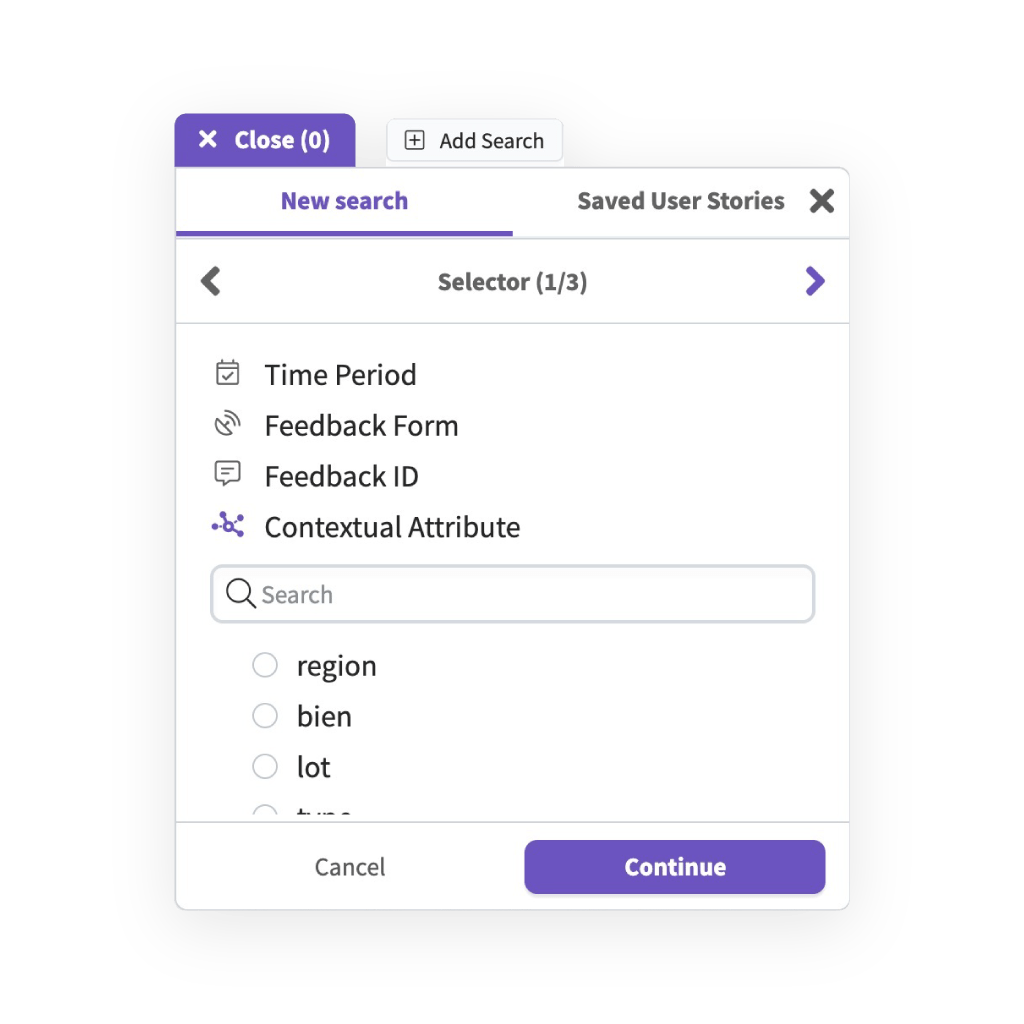

Add context to your questions

It’s great to collect feedback, but what you really need in order to start building better insights is to add context to the feedback that’s coming in. Adding demographics can usually be done as a question in most platforms (aka Context Attributes on Feedier) but having them pre-added is the best way to remove the delay

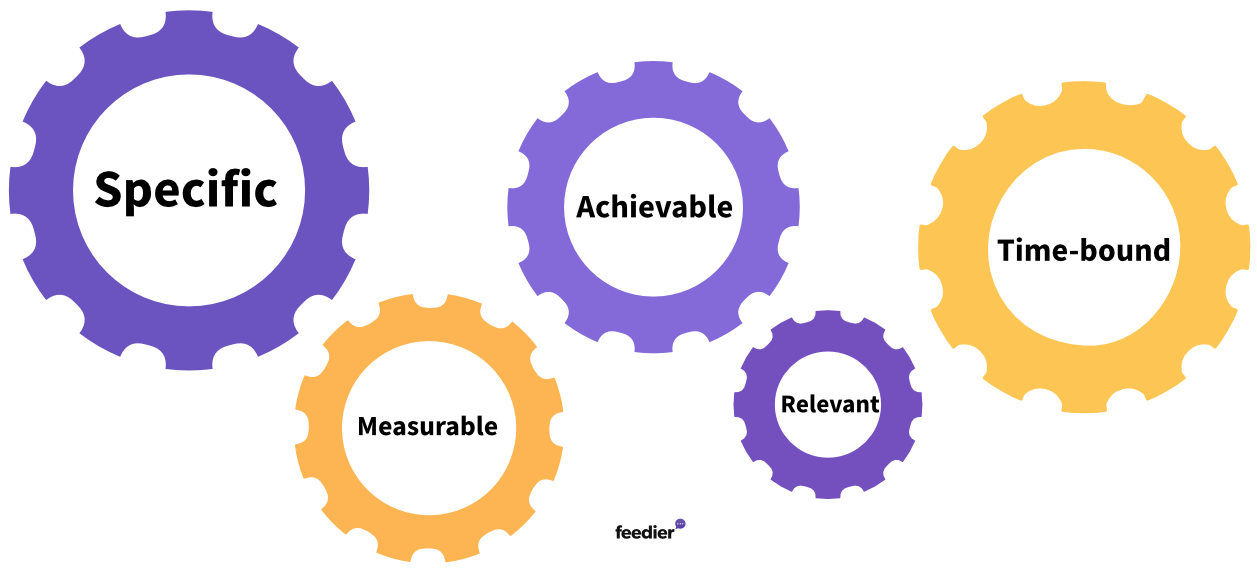

Structuring your Surveys

Use SMART goals to make sure your survey structure adheres to clear, feasible and consistent objectives.

- Specific (simple, sensible, significant)

- Measurable (meaningful, motivating)

- Achievable (agreed, attainable)

- Relevant (reasonable, realistic and resourced, results-based).

- Time-bound (time-based, time-limited, time/cost limited, timely, time-sensitive)

Key question types to use in every Survey

There’s no ‘one question fits all’ that you can use, and choosing the right type of question will be dependent on the type of audience you are reaching out to, the type of responses you’re hoping to receive, and the level of detail you wish to get out of it.

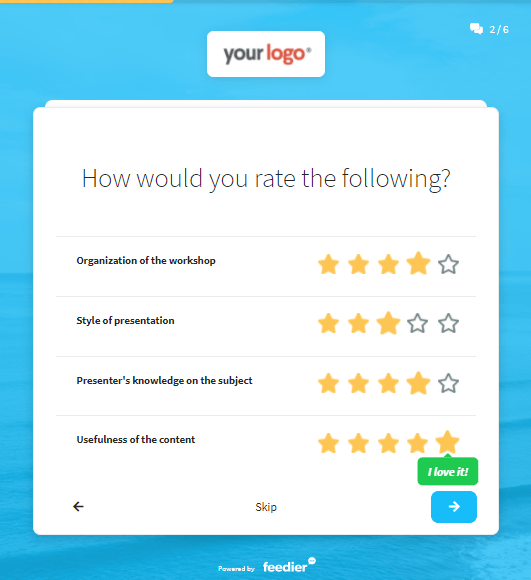

Customer Satisfaction Score (CSAT)

CSAT questions are designed to offer a 1 to 10 scale question to often describe their level of satisfaction.

The question is simple : “How would you rate your overall satisfaction?”. It is often displayed in the form of a ratings question, or as a likert scale question, for example:

The results are then measured by a composite score or as a percentage of picked responses. In Feedier’s case, both the total score, and the individual response percentages are measured for future analysis.

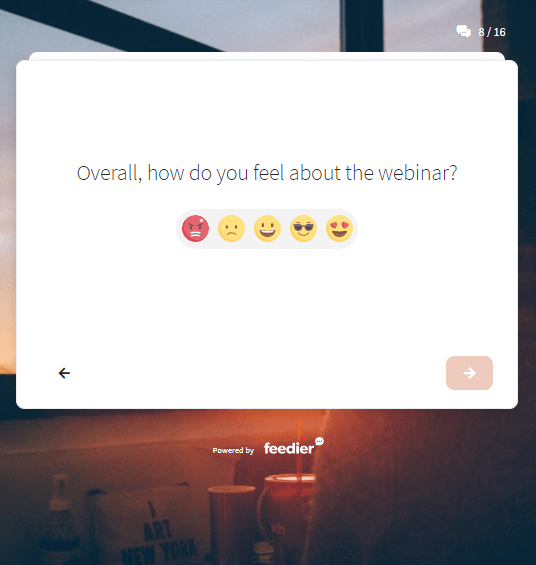

Likert Scale

The likert scale can be used to get a participant’s level of agreement, satisfaction, importance or likelihood toward a statement.

These are often designed in the style of choices, ratings or ranking question types and are often displayed with having 3, 5 or 7 options. The reason for being odd means that there’s a “neutral” stance for the participant, should they neither agree nor disagree with the statement.

Examples include:

1. Agreement

“The Checkout process was straightforward”

- Strongly Agree

- Agree

- Neither Agree Nor Disagree

- Disagree

- Strongly Disagree

2. Satisfaction

“Please rate your satisfaction with your recent customer service experience“

- Very Happy

- Somewhat Happy

- Neutral

- Not Very Happy

- Not at All Happy

3. Importance

“Rank each item in reference to its importance to you“

- Very Important

- Important

- Moderately Important

- Slightly Important

- Not Important

4. Likelihood

“Rank each iteI would recommend this product to my friends“

- Very Likely

- Likely

- Neutral

- Not Likely

- Very Unlikely

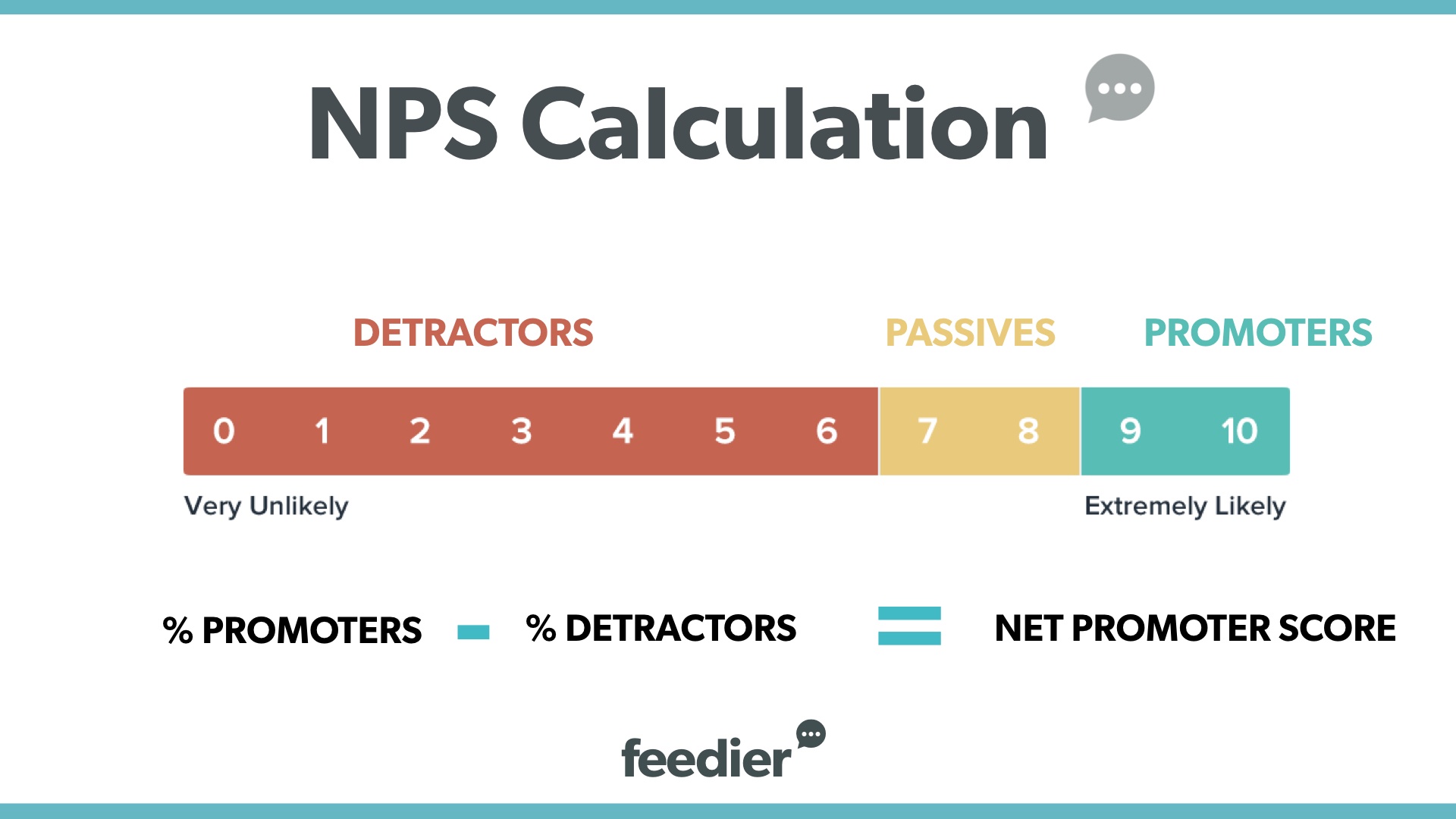

Net Promoter Score (NPS)

NPS is a score ranging from -100 to 100, calculated by asking participants one question:

“How likely are you to recommend a [product/company] to a friend or colleague?” This then gives you a clear indication of whether they’re deemed a promoter or detractor to your brand.

The idea here being that you want to target your promoters for growth opportunities, and target your detractors to understand why they don’t feel positively toward your brand/company. This can’t usually all be done in one survey however. Learn more about how to follow up with your participants post-survey.

Guttman Scale questions

Sometimes you want to funnel a participant down a particular route by asking a series of questions. Yes-No Responses, also known as Switch Questions, allows you to do just that.

Participants can self-qualify during the survey by answering questions to help you ask the right questions to the right people.

Demographic questions

As part of best practice, you should try to link up contextual information you already have on your participant and attach it to the feedback they give, but sometimes this isn’t possible.

Demographic questions allow you to gather contextual attributes of the respondent by asking for their age, geographic location, gender and more. These are then used to benchmark your results and create user stories, aka cohorts.

Unstructured questions

Open-ended questions allow you to get text-rich data, which you can then further analyze using Machine Learning text analysis software. You want to use these sparingly so not to overwhelm your participant by having them write lots of long-winded answers.

Multiple Choice questions

The tried and tested multiple choice question is still commonly used to this day due to its ability to have the participants choose from a pre-selected range of answers.

You can now make the forms more interactive by adding images as the responses, or allowing them to enter their own custom answer.

All questions have their own drawbacks, it’s about having a mixture to keep your participant engaged

The Likert Scale can cause bias of choosing only extreme answers, the CSAT may not get to the bottom of why a participant is happy or upset, the text questions may get too word-heavy, the NPS score might not actually calculate promoters and detractors the way you think.

The takeaway point being that you need to use a range of these question techniques in order to make a dynamic and effective survey for your participants. Relying heavily on one type can cause your results to skew, and can reduce your feedback response rates.

Positives of Survey tools

Survey tools as a stand-alone product can be highly beneficial for individuals looking to pick up one-off data. They aren’t however the most effective source of information for enterprise-style businesses.

Below are some reasons why Survey tools are useful for anyone looking to collect feedback.

Engage with your participants

Surveys are a great way to make your participants part of the growing process. Not only does this make them feel like they are appreciated contributors.

It also provides you with valuable insights.

Organize your questions and target certain audiences

Using a clear set of questions coupled with branching logic to help mold the flow of questions can be a really effective way of gathering useful information.

Surveys are designed to do just that, and even the simplest tools will allow you to take advantage of organization, question variability and condition logic.

Turning Negative Feedback into Positive Action

Negative feedback is, whilst hard to take, extremely useful for improving your business processes. It allows you to get closer to your customer’s pain points, it makes you work closer to your team to help solve the problem, and can ultimately uncover a glaring issue you weren’t able to find yourself.

Conversely, too much positive feedback can give you the illusion that everything is going perfectly, and so you may miss any opportunities to improve.

Negatives of Survey Tools

The irony is that more feedback can lead to a better product/experience for your participants.

Unfortunately, surveys done the wrong way using outdated or unsuitable tools can lead to a lack of trust between you and your participants. Here we explore some of the negatives that are associated with survey tools.

Bad User experience/user interface of the survey tool

We’ve known for a long time that design, appearance and user experience is a game changer when it’s done right.

If you do not provide users with a compelling experience and design, you will lose their attention.

The threat of Data Harvesting

People are now more weary than ever that their personal information can be used for future marketing materials that they don’t consent to.

Survey tools that aren’t branded well, or that come from an untrustworthy source/domain can appear unsafe to participants, and can contribute to low response rates.

Surveys that lack direction can lead to low future response rates

Surveys if not designed correctly can often lack direction and purpose. This can be picked up by the participant and can lead to reduced survey uptake in the future.

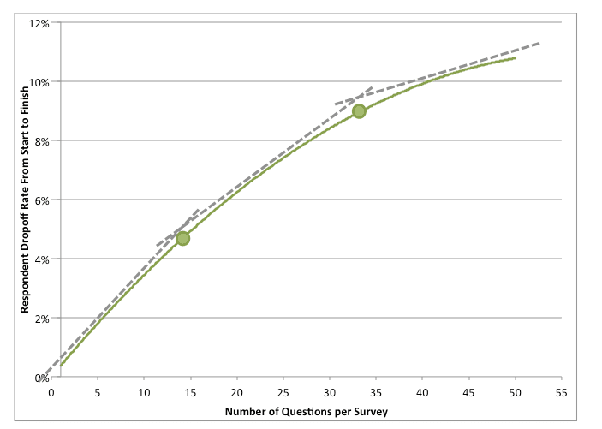

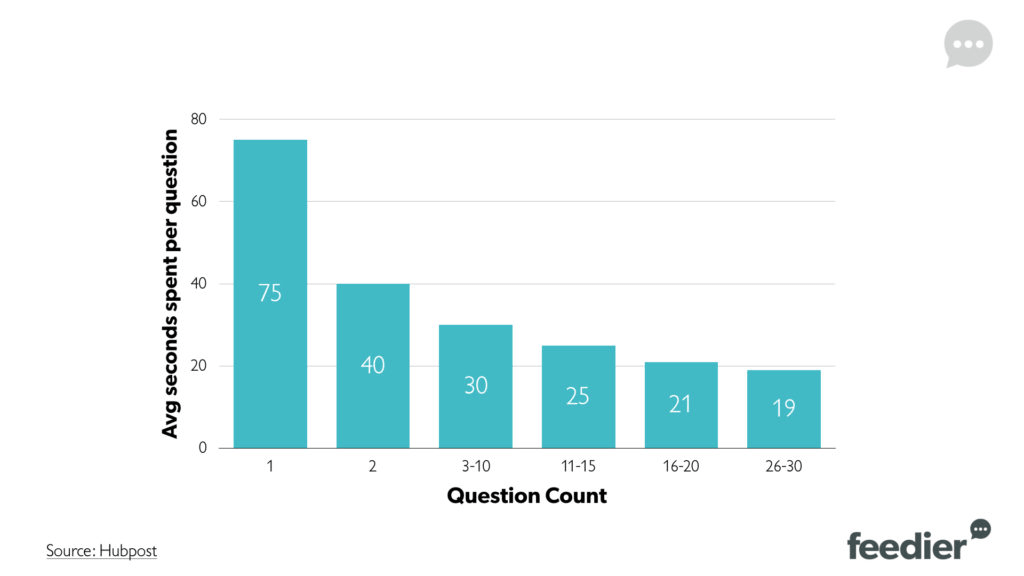

Survey Fatigue

A common negative effect of surveys is the result of a participant becoming overwhelmed by the quantity of questions or the amount of surveys they’re requested to complete. Both for, length and the use of unnecessary questions play a part in this.

Survey tools best practices

We have seen in detail the different types of questions, the advantages and disadvantages of survey tools, now let’s move on to the best practices, to boost your engagement rate.

Make your survey interactive

You want participants to complete the whole survey, so make it interactive. Use your branding, some colour, and gifs and images wherever possible to keep those answering engaged.

Describe the reason for your survey

Giving your participants context of why the survey matters to you and your business will help convince those on the fence that their view may help contribute to something bigger.

Try and keep your survey short and sweet

No one wants to be filling out a 30-minute survey. It’s tiresome – for both your participants and you. Instead, focus on key KPIs that you wish to measure and ask targeted questions based on them.

Target your audience at certain touchpoints

Whether you’re reaching out to an employee, client, or end-user of a product, all will experience various moments where they come into contact with you. Use these points of contact to target your questions to the right audience during their journey.

Set an automatic reminder to follow-up

Didn’t get a strong response rate? Set a reminder follow-up email to go out after 48 hours or so after the touchpoint to remind your audience that this really is important for them to complete.

Keep a track of your KPIs and constantly measure them against the results

Once the results are in, now is the important part. Surveys can easily get filled away under ‘been there, done that’ but what you really need to do now is collect these results over a continuous time frame.

Experience Management platforms‘ help you do this.

Act on Feedback

It’s great for the management team to start receiving key insights to the data, but it’s also important for the operational team to be alerted as soon as a negative feedback parameter is triggered.

Faster reaction times may lead to a resolution to the issue, and the participant in question might even become a promoter based on how you managed to listen and act in such a timely manner.

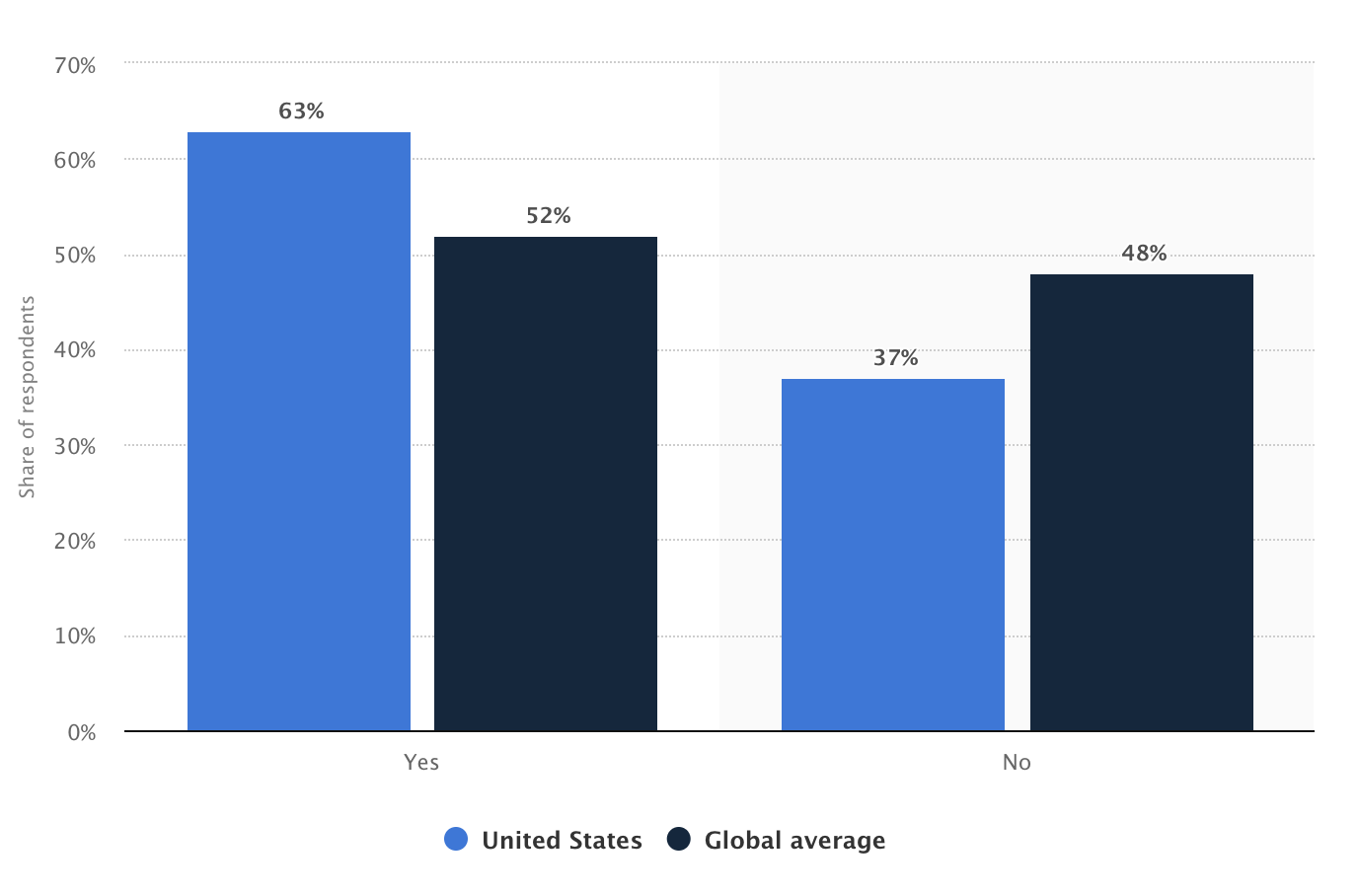

Improving your response rate

Finding the right channel to share your survey can be a daunting task. The first thing to keep in mind is, where are your touchpoints you’d interact with the prospective survey participants?

You’ll often find that they’ll interact via a website/application, email or in-person.

Getting feedback by email

Emails are still an excellent way to reach out to your participants, they can be automated based on an integration with your survey tool and CRM, or they can be done manually by email campaigns. Either way, there is a chance to get into a space where your participant is likely to check on a daily basis.

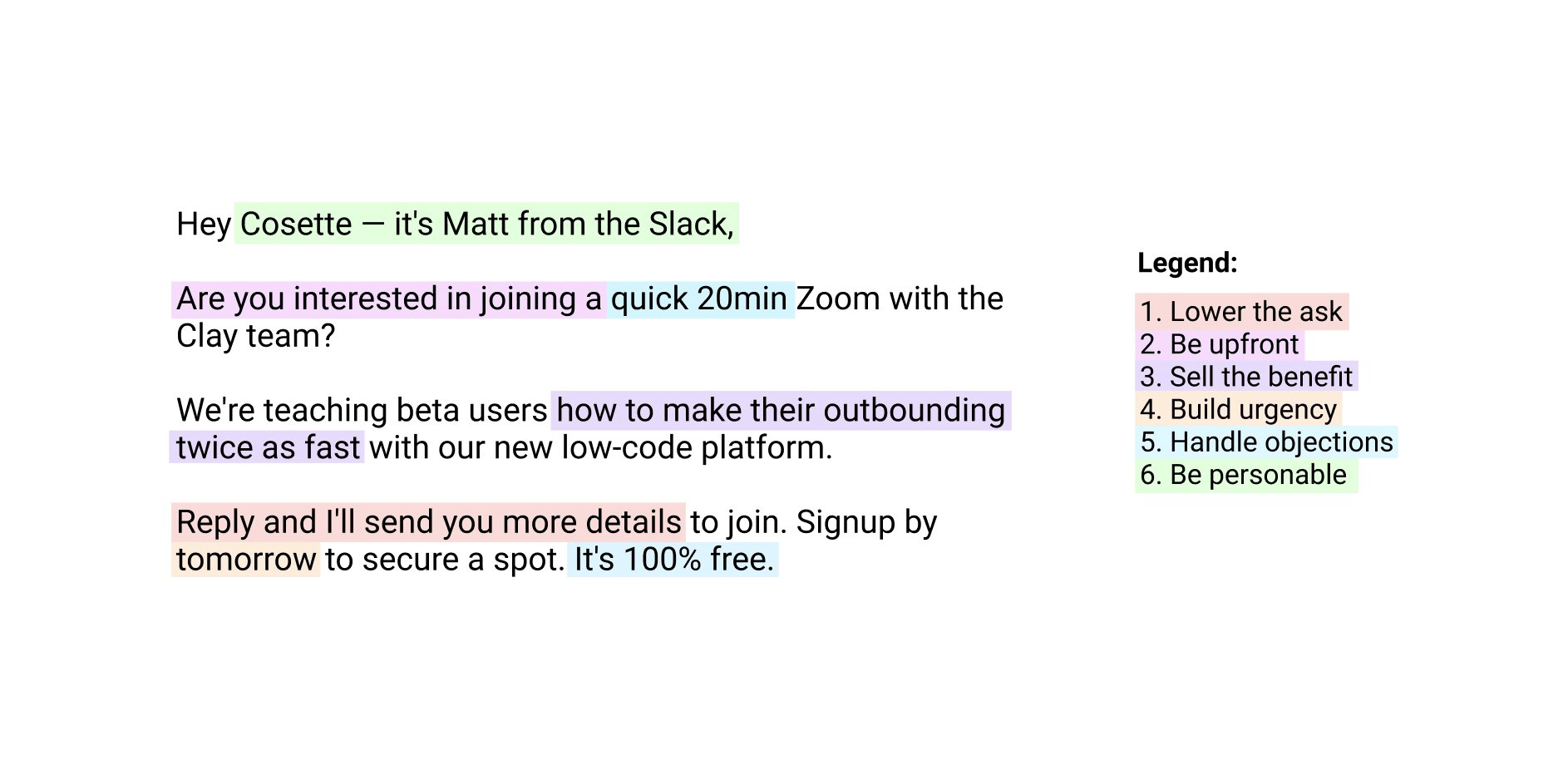

Now you just need to make sure that your email stands out.

Here are some helpful tips to improve your response rates for emails.

- A/B test the subject line. Creating a campaign and testing response rates based on subject lines is a great way of testing open rates.

- You need them to click into the form itself, so play around with the email body in order to tweak the language of how you’re asking for feedback. Be sure to: Lower the ask, Be upfront, sell the benefit, build urgency, handle objections, be personable.

- Add follow-ups to your emails in order for your participant to be reminded of the email. People have busy schedules, and emails can easily be lost.

- Use your survey tool to monitor the open, click and response rates, and tweak any of the above when rates seem to be dipping.

Getting feedback through a Website or Application

If your participants are using a web portal, your application, or visit your website at one of the touchpoints that you’d like to measure, a widget or built in iframe is an excellent way to intercept them during the process in order to ask for their feedback in real-time.

Here are some ways you can consider boosting your response-rate.

- Choose a platform that allows you to customize the widget. You may need it to pop up at a specific moment, or you may need it to appear in an area of the screen, or perhaps you need to change the widget style entirely to match your brand.

- Integrate meta-data you already have. Whilst this may not improve initial response rates, by collecting this data, you can then target individuals with follow-ups in the future if they didn’t complete their survey, or if you want to find out more information.

- Use a heat map application to highlight the areas that participants focus on, and put your widget there for maximum visibility.

Getting feedback with QR codes

QR codes are a terrific way of capturing in-person feedback without having to physically ask each individual for their feedback.

People have become used to QR codes in their day-to-day lives, but there are still ways you can help make the codes more inviting to scan:

- Add branding to the QR codes. This will make it attractive and more engaging to scan.

- Offer a reward for completing the survey. Add in a reward to the survey and promote this when printing out the QR codes.

- Pre-build your QR code with set context attributes you have inside the survey URL. This will help you understand what areas need more attention if you are planning on using QR codes for multiple campaigns/locations.

Why feedback management is so important

Using classic survey tools like Get Feedback or Survey Monkey are all well and good for basic survey collection needs. After you’ve collected your feedback data though, you now move on to the second part of the process: Data Analysis.

Choose a tool that is easy to use

Moving from one platform to another can be tricky, not to mention if you’ve never used one before.

Adding multiple departments or locations can also add to the complexity of onboarding, and using a platform that is ultimately clunky and unattractive will just mean that most people won’t use it, and you’ll never really get the fabled results you’ve been looking for.

By using a well-designed and intuitive platform, you can not only boost your user engagement, but also quickly and effectively pull data insights that matter to you.

Choose a tool that both collects AND analyses data

One of today’s biggest problems is the fact that there are tools to do everything, which can get a bit overwhelming. Some are extremely beneficial for your day-to-day work life, others are handed down from senior management with little say from your department.

This is why having a platform or application that covers multiple teams/departments is extremely beneficial.

Each department can connect their feedback to the platform, and the HQ management team can assess the data as a whole, giving a global perspective of the feedback data collected. In this way, no data is lost from having multiple tools doing the same thing.

Choose a tool that helps you measure your KPIs

There are a broad spectrum of survey tools out there that offer anything from a simple survey builder to a monolith data analysis suite with all the bells and whistles.

You want to choose a survey tool somewhere in between – one that makes it easy for you to collect feedback data and measure your KPIs without being too tech-heavy and costly.

After all, you don’t want to be paying through your nose for a product that still results in hours and hours of data management and analysis.

Automate your processes and save time

No one wants to have to manually send out campaigns on an ad-hoc basis to individual customers or employees. Instead, using certain platforms like Feedier can help you integrate your current workflows into the feedback management processes, saving you both time and energy.

Use your feedback data to inform your decision-making

By making feedback management a goal for you, you can help to not only reduce the costs of decision-making, but also you’ll have hard data that you can shape into actionable KPIs.

Summary

- Survey tools are a great way of collecting vital feedback from your participants.

- Incorporating the right type of questions in your survey can really help boost your response rates.

- In order to really elevate your processes and start to dig into deeper insights, you’ll need to select a tool that both collects feedback, but also gives you the tools to analyze your data without spending hours and hours on manual analysis.

- Make sure to choose one that isn’t clunky or overwhelming for you to use.- Always embed your context attributes into the feedback whenever possible in order to start collecting rich contextual information.

Need to know more? Book a demo with Feedier and see how the platform can help match all of your business feedback management needs.